Unrivaled revenue management solutions for your business

Channel Revenue Management Functionality was Released by Oracle SaaS in the first quarter of 2021.

According to market research and surveys, deductions can represent 5 to 15 percent of revenue, depending on the industry. From that number, 5.1 to 10 percent are unauthorized or invalid. In some industries, it is a lot higher.

Deduction comes from customers for short pay invoices based on their understanding of the trade terms or agreements. The deduction is standard for collecting promotions and disputes, shipping delays, invoice errors, pricing errors, transportation charges, damages, etc.

The most complex challenge for the receivables departments is to resolve, as there is the need for approval from outside receivables, like shipping or sales. The customer can short-pay based on their policies and procedures.

The team can also utilize business intelligence tools and solution on premise to get better results.

Different types of Deductions for revenue managers

- Trade-related deductions (e.g., trade promotions, coop, markdowns)

- Non-trade-related deductions (e.g., compliance, shortages)

Who Uses Deduction Channel Management

- Credit / AR handles the initial research and validation of all deductions

- Sales are more involved in the initial research and validation of trade-related deductions

- Compliance groups and customer service are involved with non-trade-related deductions

Advantages for Marketing and Management

- Centralized management of deduction provides visibility to all claims and increases recovery rates

- Streamlined resolution process to reduce the time taken to resolve short pay and identify invalid deductions

- Audit trails for every resolution, enhancing internal controls, reporting, and compliance

- End-to-end deduction lifecycle management with automatic settlement in Oracle Financials Cloud

- Plan and execute promotions effectively

- Manage and track complex volume rebates

- Control promotional expenses and liability

- Maximize profitability through fast and accurate claims processing

- Enhance productivity with streamlined processes and clients satisfaction

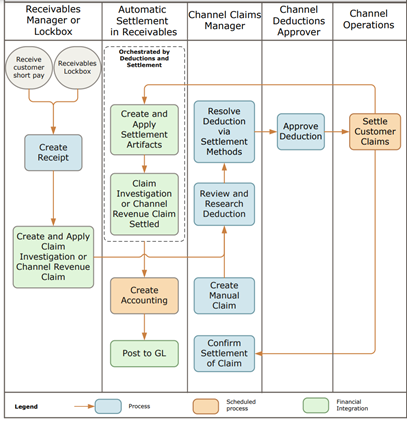

How Deductions and Settlement Work with Receivables—Process and financial reporting

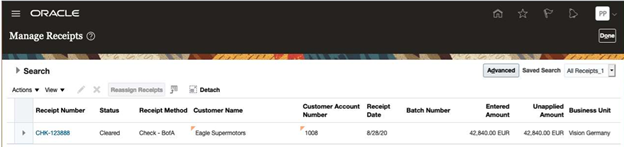

- Receive payment from customer short pay

- Create claim investigation

- Research and approve the claim

- Settle claims

- Verify claims receivable

Business Process Flow to maximize revenue

Process Receive Customer Short Pay for Damaged Items

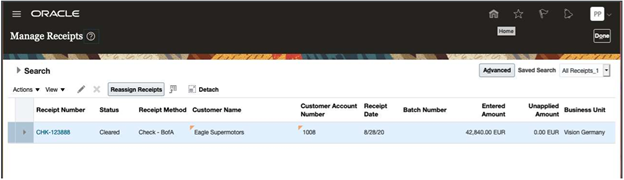

1. Create Receipt and Apply

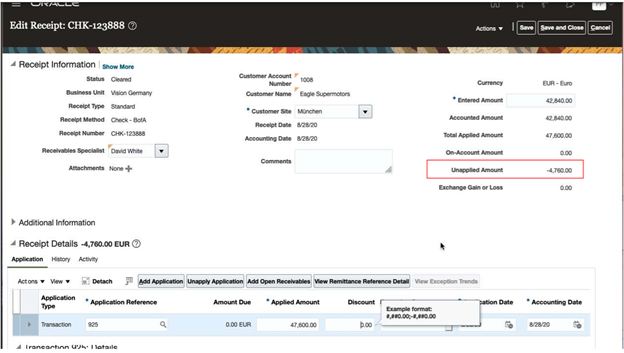

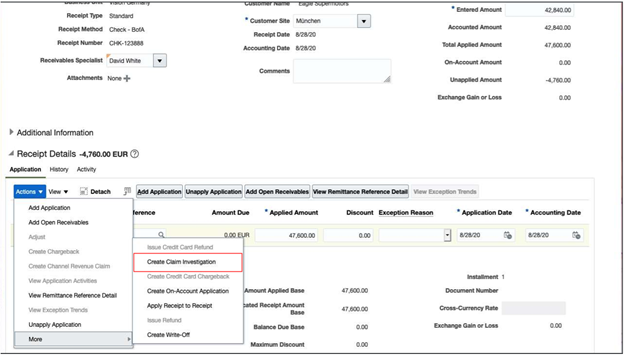

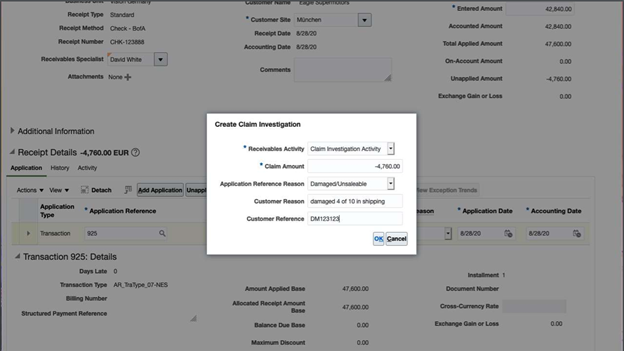

2. Create Claim Investigation

Claim Amount defaults; other details can be entered if available.

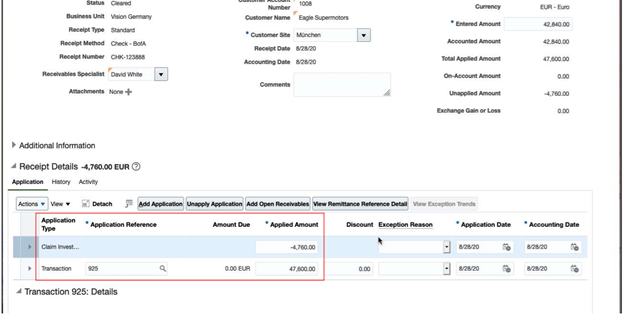

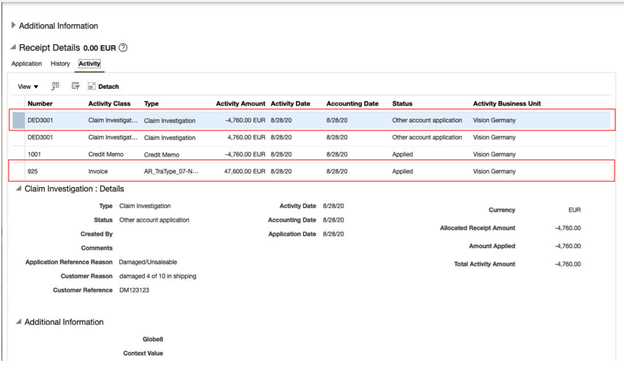

The receipt now shows full payment applied to the invoice, and a claim investigation is used for the remaining amount.

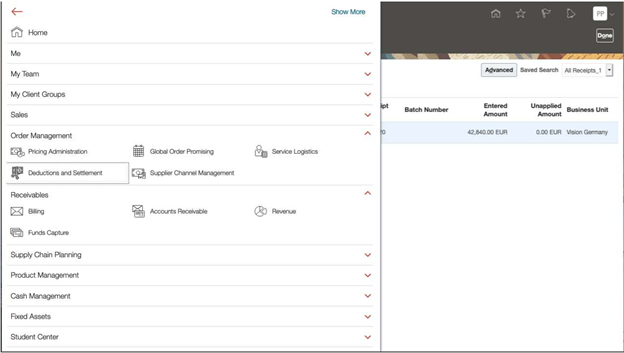

Log into Channel Management

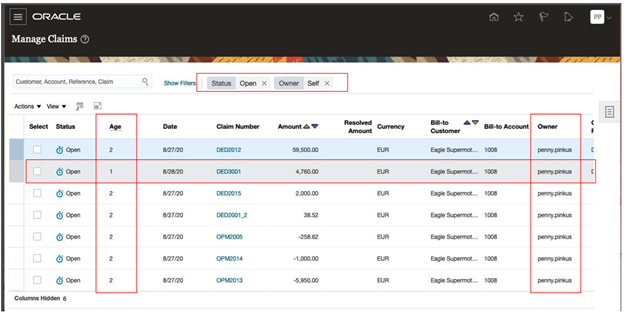

3. Research and Approve Claim

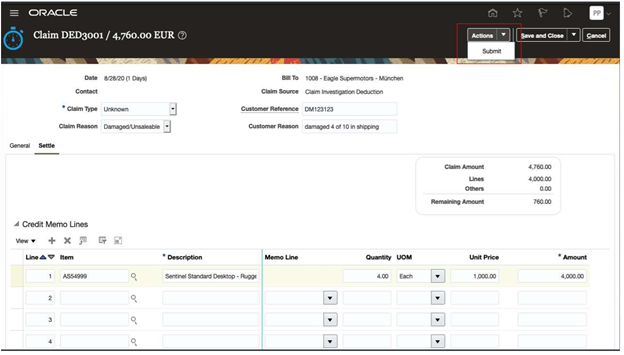

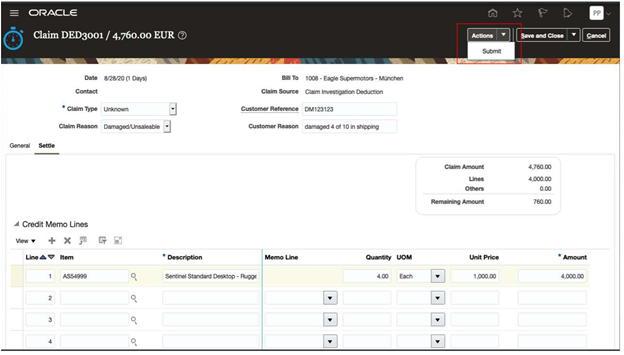

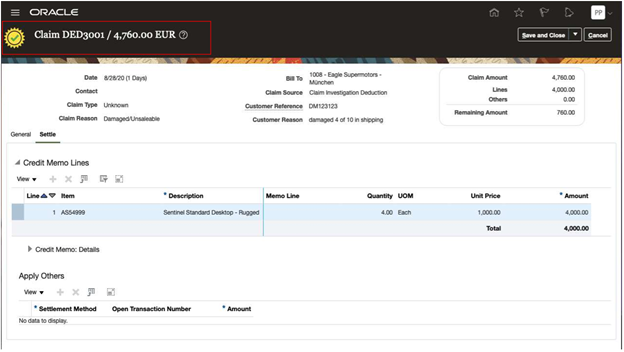

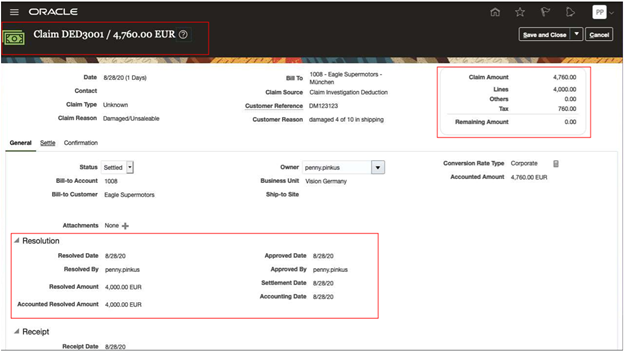

After investigating the short pay, a credit memo can be created on the Settle Tab to resolve the claim. The credit memo line should be automatically created and submitted for approval.

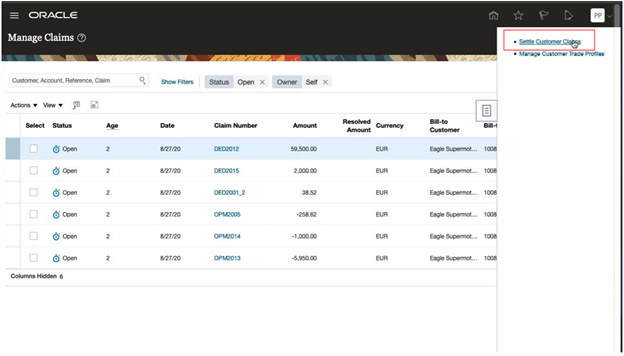

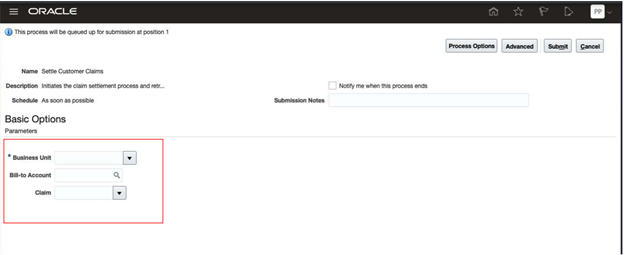

4. Click Settle Customer Claims or Run the process "Settle Customer Claims."

Status shows as Settled in the General Tab

Log Back receivable

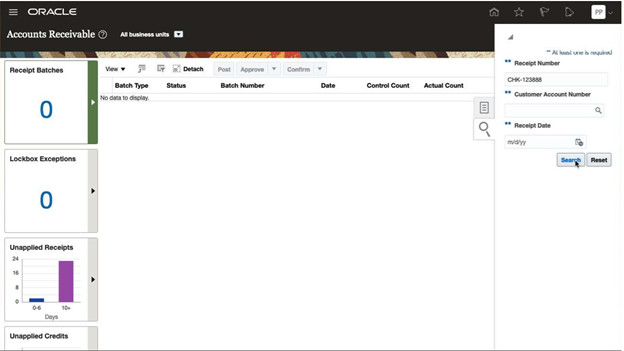

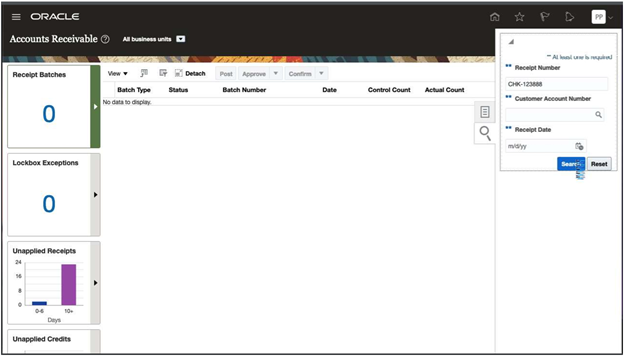

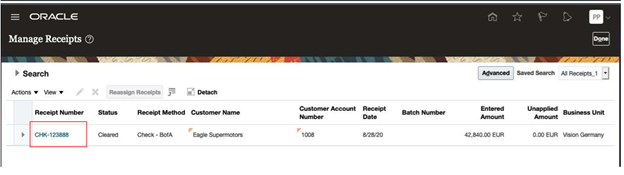

5. Verify Claims in Receivables

The first row shows the claim investigation applied. The third row shows the credit memo used upon settlement, and the second row shows the claim investigation unapplied. The fourth row shows the invoice applied.

Taking on Oracle’s Revenue Management solution, an organization can now focus on amplifying the reach of business rather than fretting over different and complex payment processes across all its channels. As any industry knows, a streamlined software solution is extremely important to reduce costs and management time dedicated to payments and deductions.

It allows a company to attain transparency and optimization in their overall finance process. Oracle RMCS offers a complete framework for collecting data, configuring reconciliations, and analyzing the information. This is a very necessary step when accurate, complete financial are needed for the entire business.