Introduction: Finance Service Management

In movies, a man walks into a bank and siphons off the entire money and walks out, using a fake identity. We all wonder if this can be pulled off at this time, when cybersecurity is getting much more difficult to breach. Thanks to the development that FinTech has witnessed in the last few decades, we now have face-reading biometric verification that makes banking more secure.

Be it a financial transaction or other financial planning, banking is already at our fingertips. A large amount of data lies with the institution that is used by Artificial Intelligence (AI) to create services in the form of apps to render efficient personalized services. And experts suggest that in the next decade, there will be many changes creating major disruptive technology. The leap in big data, advanced analytics, and artificial intelligence brings in the big disruptive technology. Expectations for a seamless and personalized digital experience are increasing, and customers are spoiled for choice these days.

Challenges Faced by the Banking Sector

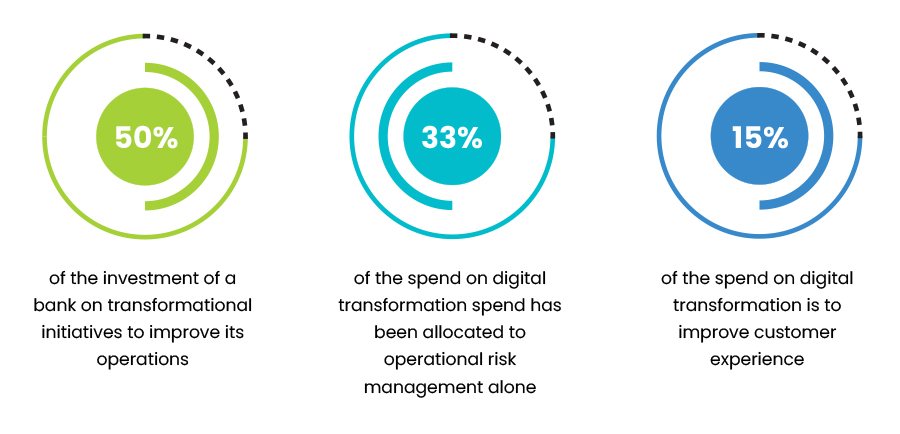

According to IDC

The challenges that financial institutions face because of which customer experience in financial services are hindered:

- A gap in the process across channels that are paper-based or via email, which get lost in departments

- Processes that include different departments and are not connected, leading to communication getting lost

- Legacy systems that are siloed and are difficult to connect workflows, queries, and data

For any banking institution to function properly, there should not be any glitches in the operational workflow. The retail banking system faces siloed legacy applications, gaps in processes, and disconnected customer and employee experiences. Operational excellence is the key to resolving these issues, through which a modern and efficient delivery process can be achieved throughout the customer's lifecycle.

Oversee Outcomes to create value

The Information Technology Business Management (ITBM) combines Project and Portfolio Management (PPM), Financial Management (ITFM), and Application Portfolio Management by leveraging its other features, and this application platform helps analyze the actual costs of all services. It rationalizes applications and investments to focus more on innovation and transform the delivery and execution of new services with agile methodologies.

IT (Information Technology) Business Management solutions help organizations manage demand, balance resources, handle agile and waterfall projects, perform budget planning, and map costs to technical and business services. The advantage of ITBM is that it runs more like a business unit and aligns well with the rest of the organization.

The ITBM solution offers a centralized place for simplified visibility throughout the demand process. Organizations can align their investments to business strategies and, with the help of ITBM ServiceNow, take innovations to outcomes.

Demand Management

All strategic requests from the business can be centralized, and the investment decision process for all new products and services can be consolidated. Corporate initiatives can be supported by simplified ideation to improve, drive, and grow the business.

Portfolio Management

Organizations can create portfolios that are collections of related programs, projects, and demands. They can perform the financial planning then and monitor the status of these portfolios. Innovative ideas from employees can be collected, and this can be done from a single location.

Resource Management

Companies can leverage management and forecasting capabilities in a single tool. By viewing both strategic and operational work, they can allocate the staff more effectively to determine which resources are available at any point in time.

Governance, Risk, and Compliance (GRC) with ServiceNow

The benefits of Policy and Compliance Management help organizations reduce manual effort and allow resource reallocation with automated compliance testing while saving time and money. It reduces risk by resolving issues before the audit findings by using real-time insights into compliance. It simplifies compliance by testing controls and complying with numerous regulations through our common framework.

ServiceNow financial management helps in embedding governance, risk, and compliance intuitively across workflows and monitoring risks. They generate real-time reports, alerts, and risk-mitigating activities. It can map business services to underlying IT, facilities, and other third-party vendors to absorb and adapt to shocks. Based on the business impact, ServiceNow can automate the response to breaches and keep a tab on regulations, reducing the cost of compliance, and managing change effectively.

ServiceNow Financial Service Operations with Jade Global

Using the ServiceNow platform, companies can build customized applications and deliver real-time business transformation and innovation. With its expert team, Jade Global can help financial services institutions work through the dynamics of the changing environment and barriers and succeed. We can advocate a more comprehensive approach to compliance, risk, and governance, streamlining the workflow through ServiceNow Professional Services and integrating systems without compromising on the aspect of security.