Summary: Automating tax compliance with intelligent systems integrated into Workday Payroll, HCM, and Financials streamlines processes in real-time. This blog will elaborate on how this approach minimizes errors, ensures ongoing compliance, and enhances operational efficiency. With this system, organizations can expand globally while maintaining alignment with the latest tax regulations.

Managing tax compliance has always been a challenging task for businesses, especially with tax laws constantly changing across various regions. Traditionally, companies relied on spreadsheets and manual data entry, which often led to delays, errors, and costly audits.

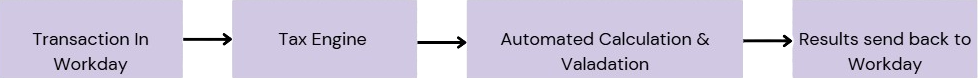

AI-powered Tax automation has completely changed the game. By integrating smart tax engines into systems such as Workday Payroll, HCM, and Financials, businesses can automate tax calculations in real-time. This enhances accuracy and ensures compliance while eliminating manual tasks, enabling organizations to mitigate risks and grow with confidence.

From Manual to Automated Tax Compliance

Tax compliance has been a niche topic across industries. It can be streamlined by replacing manual, error-prone processes with automated systems. By integrating smart tax engines into platforms like Workday, businesses can calculate taxes in real-time based on factors such as employee location, transaction type, and current regulations—without relying on spreadsheets or constant updates. These systems are always up to date with the latest tax laws, ensuring accuracy and compliance with current regulations. This shift reduces audit risks and processing time and also makes it easier for businesses to expand across regions.

Key Benefits of AI-powered Tax Compliance Automation

- Reduced Risk and Improved Accuracy: Real-time, rule-based tax calculations reduce human errors, helping avoid penalties and audits.

- Increased Efficiency and Speed: Automates payroll and financial tax processes, drastically cutting down manual efforts and processing time.

- Scalable Global Compliance: Supports seamless expansion into new regions with built-in localization and compliance management.

- Always Up to Date: Tax engines are maintained by experts and auto-updated, eliminating the need for manual rule tracking.

How Jade Global Helps

At Jade Global, we specialize in helping businesses maximize the full potential of Workday, particularly for AI-powered tax automation. With over 20 years of experience, we provide customized Workday Consulting Services that integrate intelligent tax engines into Workday Payroll, HCM, and Financials, ensuring seamless, real-time tax calculations and compliance across regions.

As a certified Workday Partner, we provide comprehensive end-to-end tax automation services, encompassing initial system design and integration, as well as ongoing support and updates. Our AI-driven solutions continuously update tax engines with the latest regulations, eliminating the need for manual tracking and reducing the risk of errors and audits.

Whether scaling your business globally, managing complex tax structures, or automating tax compliance processes, our team of Workday experts will guide you through every stage, optimizing your tax operations and helping you achieve greater efficiency and accuracy.

AI’s Business Impact: What the Numbers Say

A survey of 640 finance professionals shows that Finance AI Pioneers — early adopters of AI — report significantly higher confidence in AI’s business value compared to the overall finance cohort.

- 43% of AI Pioneers believe AI increases revenue and profits, versus 30% of overall respondents

- 39% of Pioneers trust AI for better data-driven decision-making, compared to 32% overall.

- 25% believe AI helps lower costs, compared to 20% of the overall group.

Future scope of AI-powered Tax Compliance in Workday

- Predictive and autonomous compliance: AI will enable Workday to automate tax calculations, predict tax risks, and manage filing with minimal human intervention.

- Global, real-time adaptability: Continuous AI integration will allow Workday to instantly adapt to tax law changes across regions, supporting seamless international expansion and compliance.

With AI-powered automation integrated into Workday, companies transform tax compliance into a reliable, scalable, and efficient process, freeing teams to focus on strategy rather than manual data entry and spreadsheets.

Conclusion:

AI is transforming every aspect of business, particularly in how businesses manage tax compliance. Through Workday’s seamless integration with AI-powered tax engines, companies can automate tax calculations, stay up to date with global regulations, and reduce errors. This will help them achieve greater operational efficiency. As organizations continue to scale globally, embracing this intelligent approach to tax compliance will reduce risks and drive significant cost savings, allowing businesses to focus on what truly matters: strategic growth and value creation

Ready to transform your tax compliance processes?

Connect with Jade Global today to learn how our AI-powered tax automation solutions can optimize your Workday system and ensure smooth, scalable, and compliant tax management.

FAQs:

Q1. What is AI-powered tax compliance in Workday?

AI-powered tax compliance in Workday utilizes intelligent tax engines to automate tax calculations and ensure real-time compliance with global tax regulations. By integrating these systems into Workday Payroll, HCM, and Financials, businesses can avoid manual errors, reduce risks, and streamline tax compliance without relying on spreadsheets or constant updates.

Q2. How does AI in Workday ensure global tax compliance?

AI in Workday ensures global tax compliance by automatically updating tax engines with the latest regulations across regions. This enables businesses to automate tax calculations in real-time, ensuring accuracy in Workday Payroll tax automation and keeping pace with the constantly evolving global tax laws.

Q3. How does AI improve tax accuracy in Workday Payroll?

AI improves tax accuracy in Workday Payroll by automating real-time tax calculations based on employee data and current regulations. The integration of AI-powered tax automation in Workday Payroll reduces human errors, ensuring accurate tax reporting and compliance with the latest tax laws.

Q4. What is the role of AI-powered tax engines in Workday?

AI-powered tax engines in Workday automate tax calculations and filings in real time, ensuring tax accuracy and compliance. These engines are integrated into Workday Payroll, HCM, and Financials, allowing businesses to manage complex tax regulations and streamline processes without manual intervention.

Q5. Can AI automate tax calculations and filings in Workday?

Yes, AI can automate both tax calculations and filings in Workday by integrating intelligent tax engines into Workday Payroll and Financials. This automation ensures real-time compliance, reduces manual work, and minimizes errors, helping businesses stay up to date with tax laws and regulations.

Q6. How does AI in Workday reduce manual tax processes?

AI in Workday streamlines tax processes by automating calculations, eliminating the need for manual data entry, and minimizing human errors. This automation, particularly in Workday Payroll tax automation, ensures real-time compliance and frees up resources for more strategic tasks.

Q7. What is predictive tax compliance in Workday?

Predictive tax compliance in Workday uses AI to forecast potential tax risks and ensure proactive management. By integrating AI-powered tax engines into Workday, businesses can predict tax liabilities, automate calculations, and maintain compliance, all while enhancing payroll tax automation.

Q8. How does AI-driven tax automation help businesses save costs?

AI-driven tax automation streamlines manual processes, minimizes errors, and ensures compliance, resulting in cost savings in both time and resources. In Workday Payroll tax automation, AI minimizes the need for manual updates, reduces penalties from errors, and increases overall operational efficiency, allowing businesses to focus on growth.