Generally, Inbound bank integration is required to automatically upload bank statements to Oracle Cloud fusion applications without any integration tool.

Outbound integration with a bank is required to send AP positive pay files to the bank.

Requirements for Oracle Fusion Applications

Pre-requisites: Oracle Fusion Cash Management application and Payables module enabled, and a bank should provide SFTP/HTTPS URL, User authentication details (username and password), or SSH authentication key. Folder creation for Inbound and outbound. Whitelisting protocols.

The Oracle Fusion applications support the following statement file formats:

BAI2

SWIFT MT940

EDIFACT FINSTA

ISO20022 CAMT052 V1 - camt.052.001.01

ISO20022 CAMT053 V1 - camt.053.001.01

ISO20022 CAMT053 V2 - camt.053.001.02

ISO20022 CAMT053 V3 - camt.053.001.03

Note: The import process supports files with the following file extensions: *.txt, *.dat, *.csv, *.xml, *.txt, and *.ack.

Inbound Interface: Auto Bank Statement upload and Cash Management in Oracle Fusion

Before starting the integration, we must connect with the bank and request the bank to provide their HTTPS/SFTP server details and the inbound folder must be created on the same server location.

Please follow the DOC ID below to get the Oracle IP to address details, download the IP address file from there and send it to the bank to do the whitelisting so that we can have access to the server from the Oracle Fusion application.

IP Allowlist for Web Service Calls Initiated by Oracle Cloud Applications (Oracle Fusion Cash Management)(Doc ID 1903739.1)

Provided below are the steps to integrate the Oracle fusion application with the bank to auto-upload bank statement files to Fusion. The following example will be using a BIA2 format file.

Oracle Fusion Cash Management integrates with Fusion Payments to take advantage of payment transmission configuration features to automate the bank statement file import process. This process leverages the transmission of the payment feature to connect to the bank and download the bank statement file for subsequent processing and loading into Oracle Fusion Cash Management.

Here are the detailed steps to setup automatic bank statement file import:

1. Setup Payment System - The payment system represents the financial institute or bank in Fusion Payments

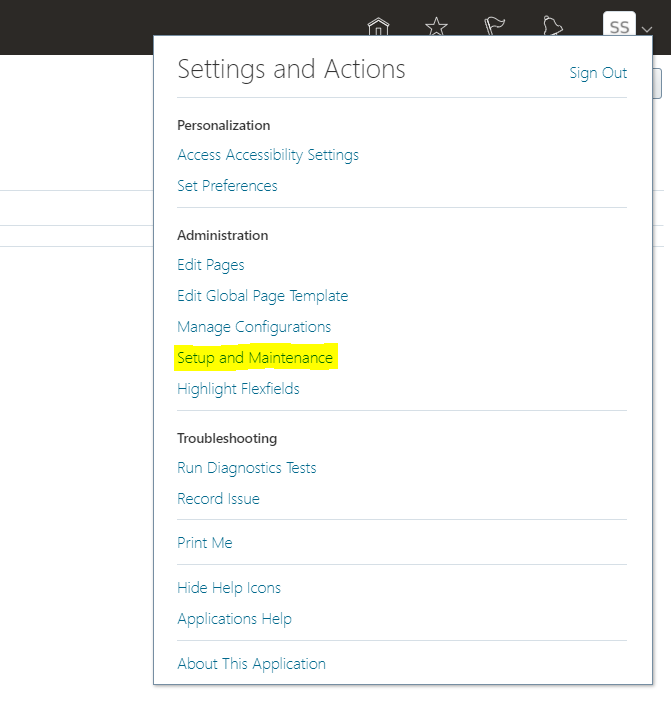

Navigation: Setup and Maintenance ----> Manage Payment System

2. Setup Payment Transmission Configuration - Transmission Configuration contains the connectivity details for the financial institute or bank and the bank provides this connectivity information. Fusion Payments support the following protocols for connecting and retrieving a file from a bank server:

- Secure File Transfer Retrieval Protocol for Static File Names (SFTP_GET) – The bank will provide the SFTP server details, including SFTP server host/IP, port, and credential details and then create a transmission configuration using these details. Note: Starting Release 13B (13.18.0.5.0), SFTP GET uses proxy-based SFTP connection. There is no need to engage Oracle Support to open ports and enable SFTP connection.

- HTTP(s) GET Request - Bank will provide SSL-enabled destination URL for connecting and retrieving the statement file. This URL can have authentication enabled.

HTTPS_GET protocol does not support the exchange of any dynamic tokens.

SFTP protocol supports the dynamic file names upload.

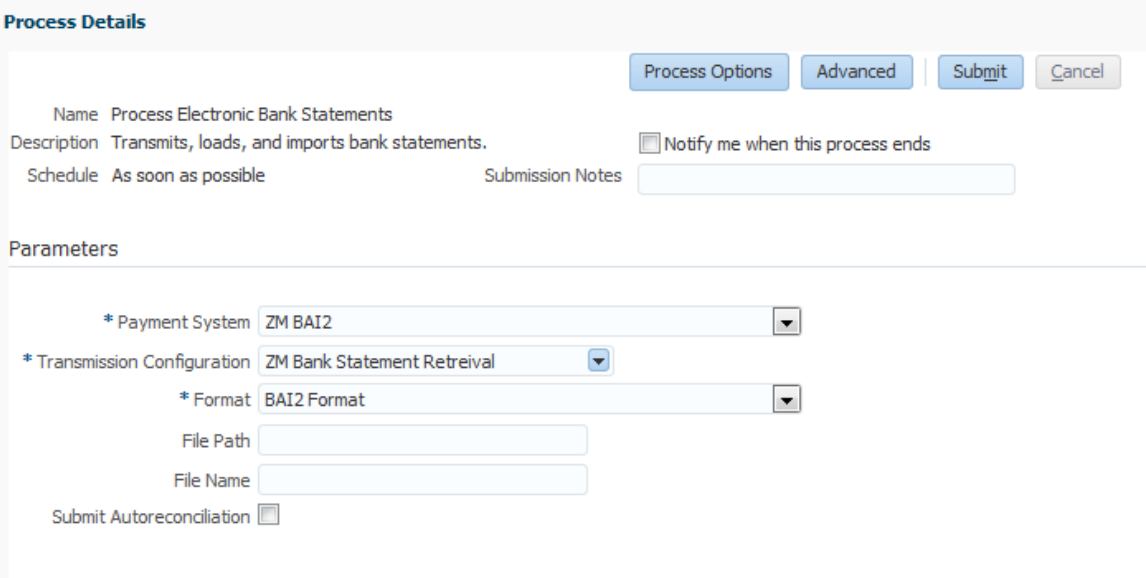

3. Schedule Process Electronic Bank Statement Request - This ESS process performs the following tasks:

- Connects to bank and retrieves bank statement file

- Process and load bank statement file into Oracle Fusion Cash Management

Submit the ESS job as shown below:

Outbound Interface: AP Positive Pay File Sent to Bank SFTP Location

Pre-requisites: Bank should provide SFTP server authentication details (username and password). A folder must be created to place the AP positive pay files at the provided location.

Steps:

a) Create the Payment Format

b) Create the Payment Process Profile

c) Create the Bank Accounts

d) Create the Payment Process Request Template

e) Create Transmission Configuration

a) Create the Payment Format

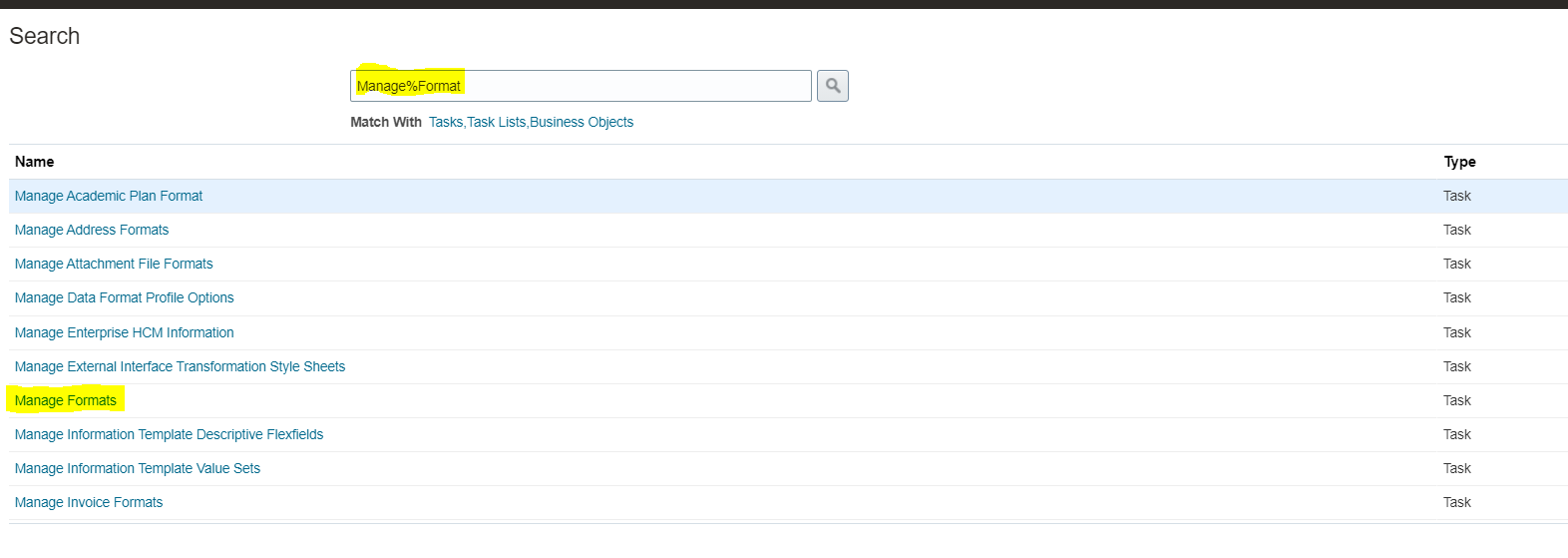

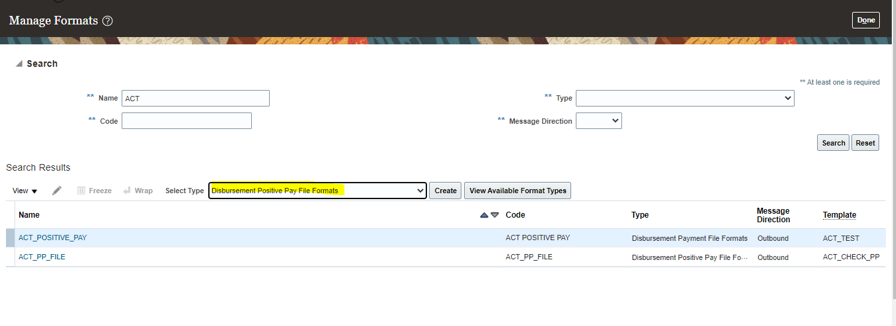

Navigate to setup and maintenance -> Manage Formats and Click on “Create.”

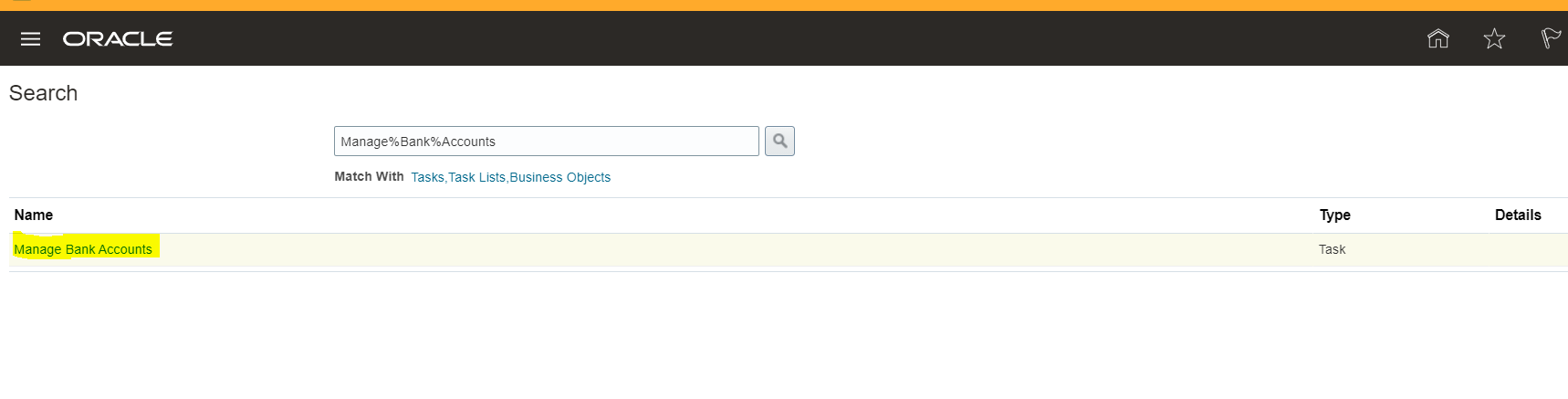

1. Navigate to Setup and Maintenance

2. Search “Manage Formats” Task

3. Click on ‘Create’ Select Type as “Disbursement Positive Pay File Formats”

4. Add the Template in the payment format

b) Create the Payment Process Profile

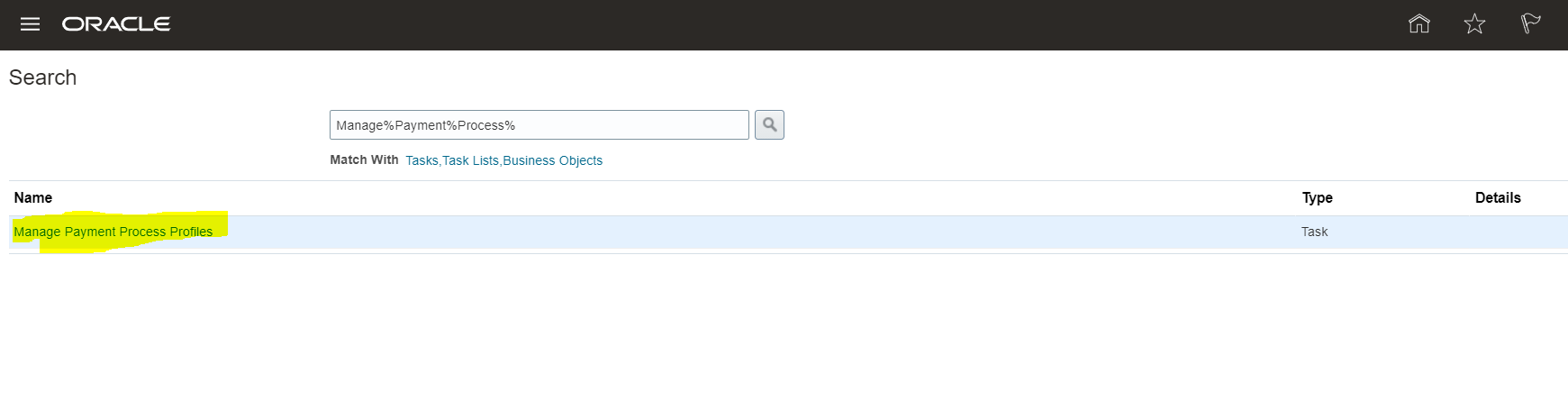

1.Navigate to setup and maintenance ->Manage Payment Process Profiles, Search for the Payment Process Profile

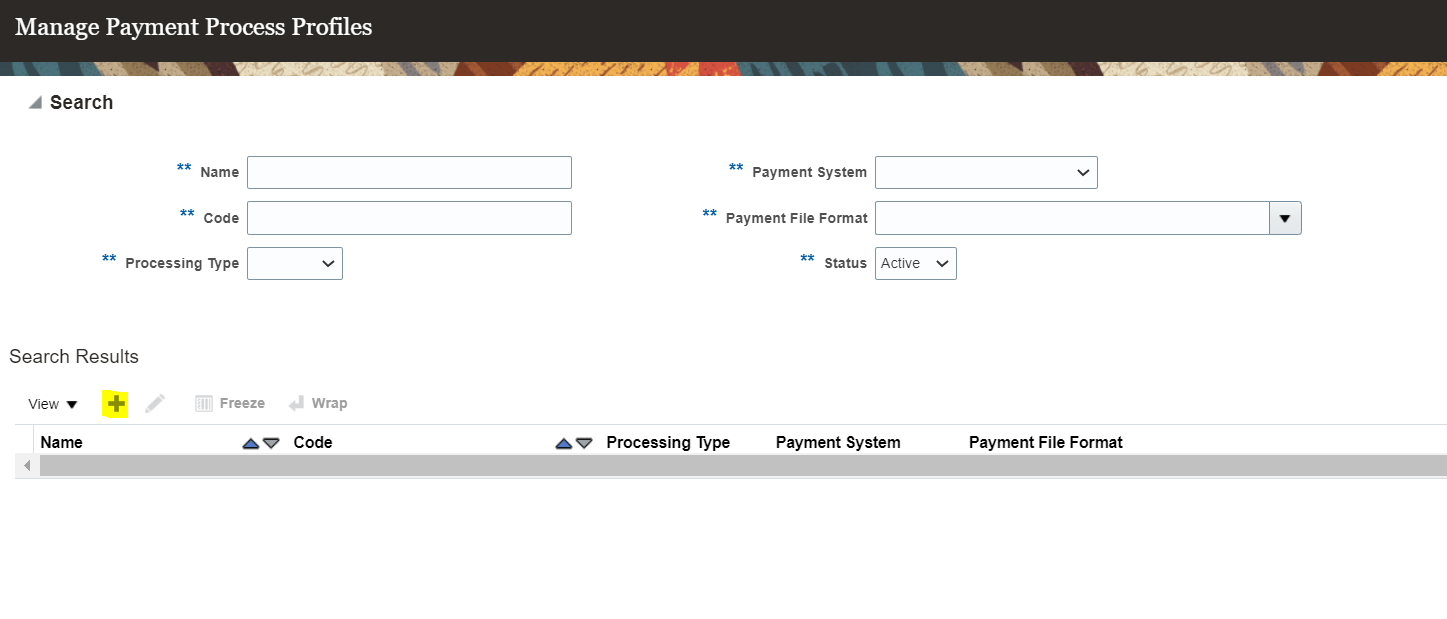

2. Click on the ‘+’ icon to create the Payment Process Profile. Now add the Payment File Formats.

3.Adding Format to the Payment Process Profile

Provide Name, code, and select processing type as Electronic

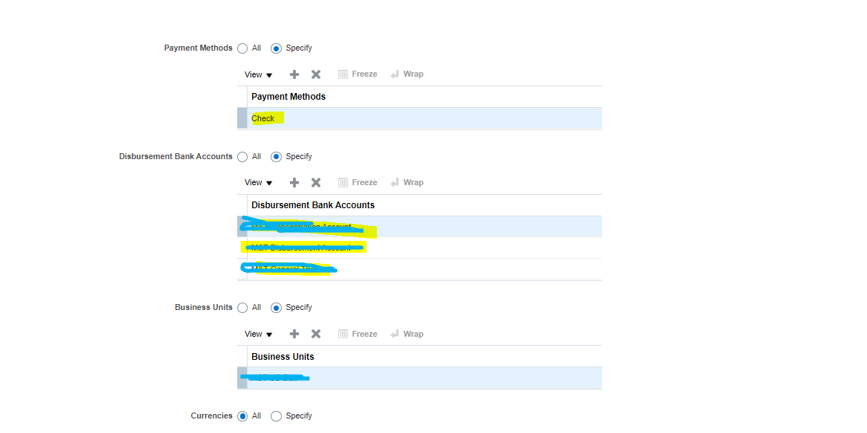

4. Go to “Usage Rules” and select the Payment Method as “Check,” and click Save to commit the changes

5. Click on “Reporting” and select Positive pay Format.

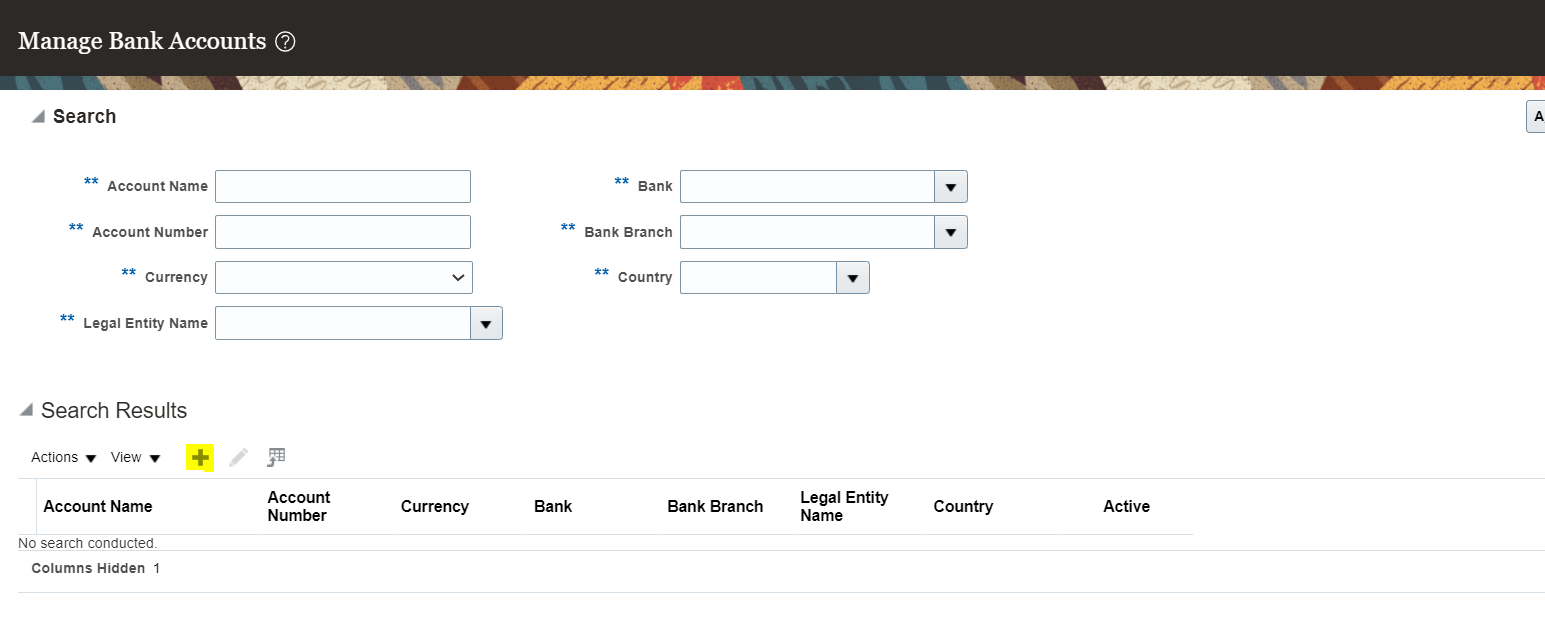

c) Now Create the Bank Accounts

1. Navigate to setup and maintenance -> Manage Bank Accounts

2. Create the bank account by clicking on the “+” icon

3. Provide all the required details

4. Create the payment document

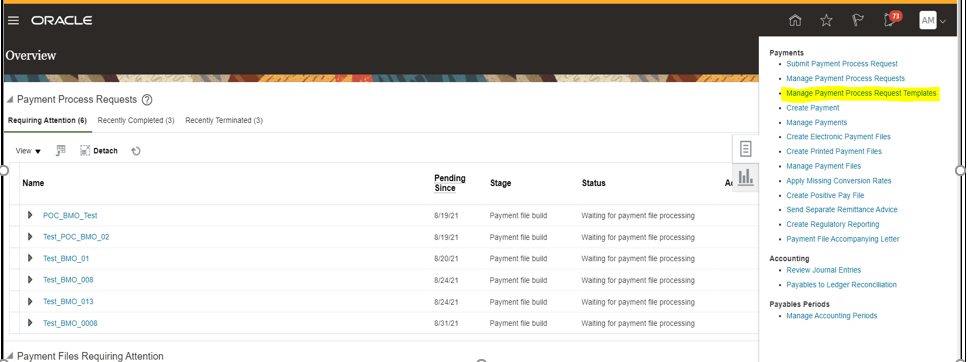

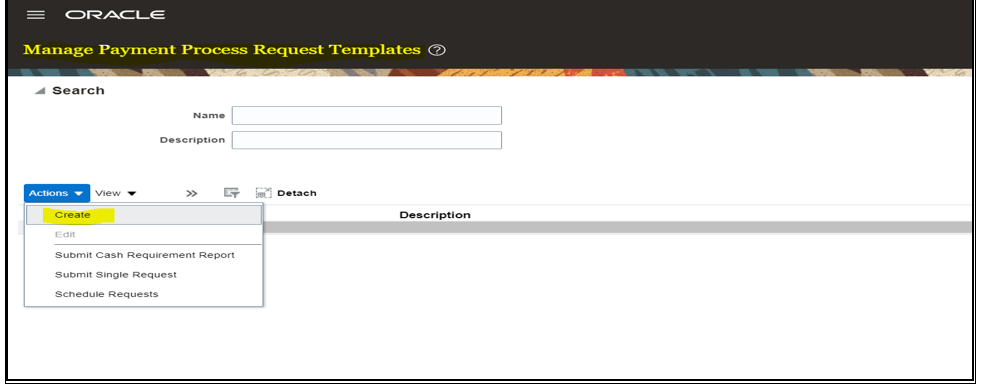

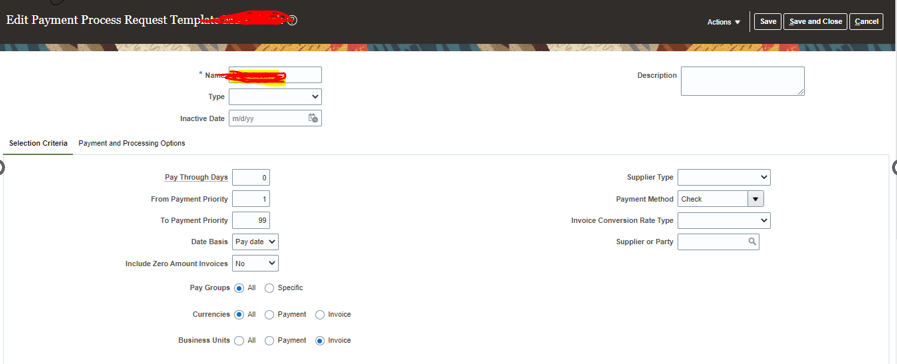

d) Create the Payment Process Request Template

1. Navigate to Oracle Cloud Home>Payments

2. Navigate to Manage Payment Process Request Templates

3. Create the PPR Template

4. Provide the details as follows in the “selection Criteria”

5. Provide the details in “Payment and Processing Options,” and click on save and close.

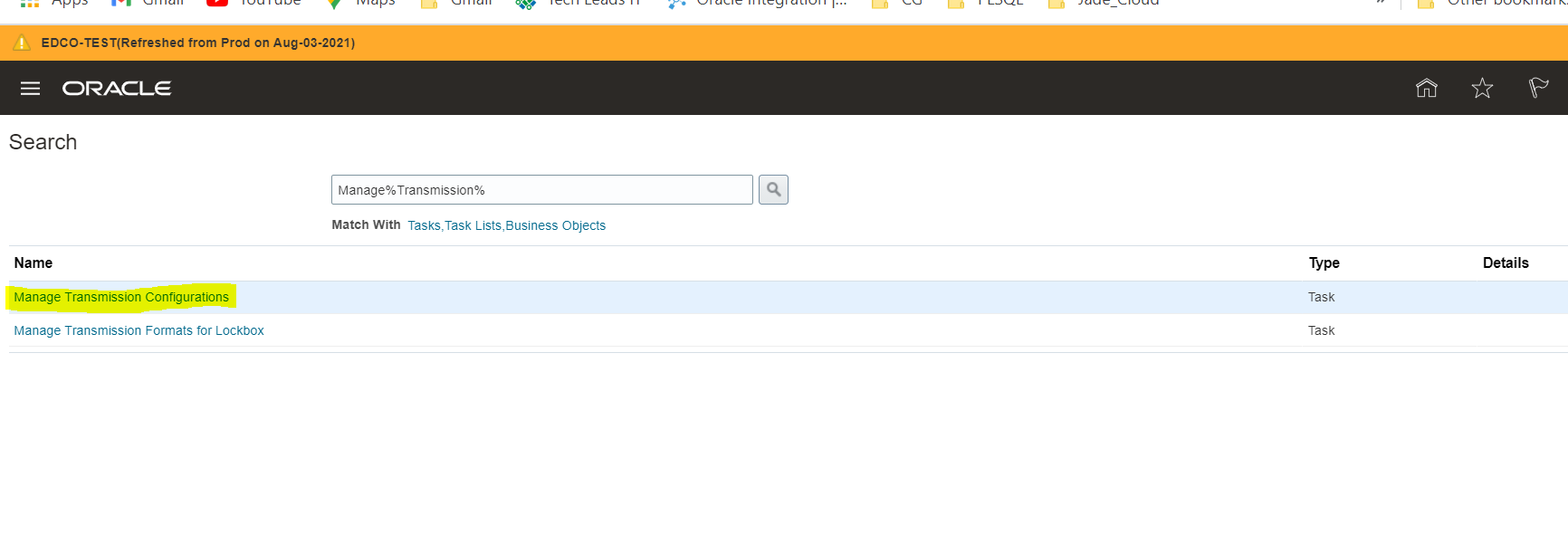

e) Create Transmission Configuration

1. Navigate to Setup and Maintenance to Manage Transmission Configurations

The setups for the Positive Pay File

a) Setup the STFP Transmission for the Positive Pay

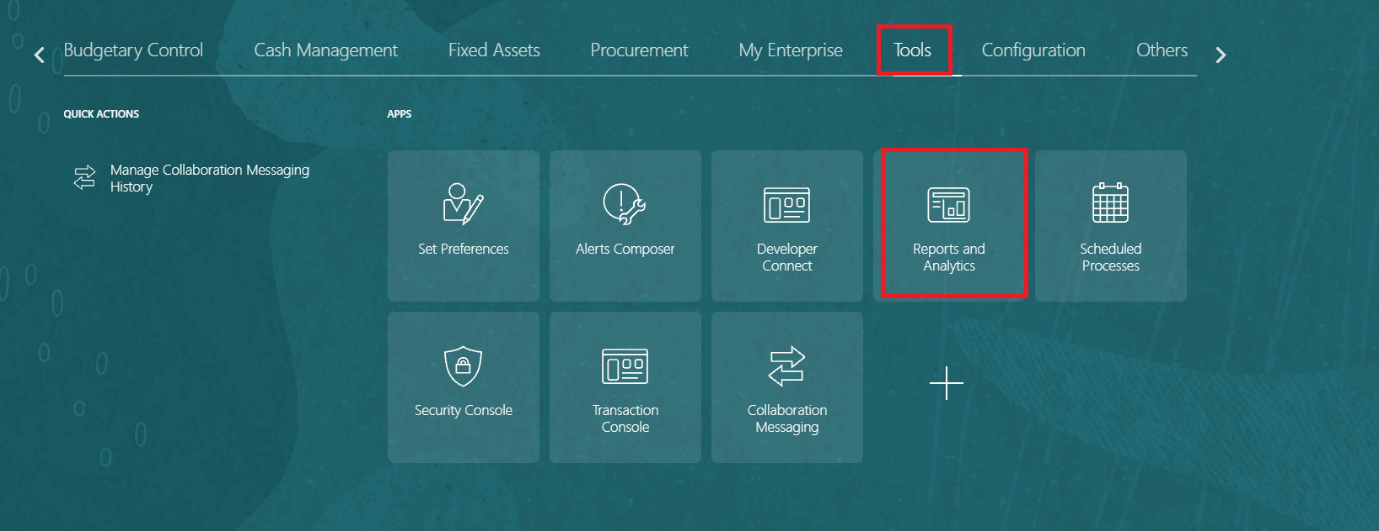

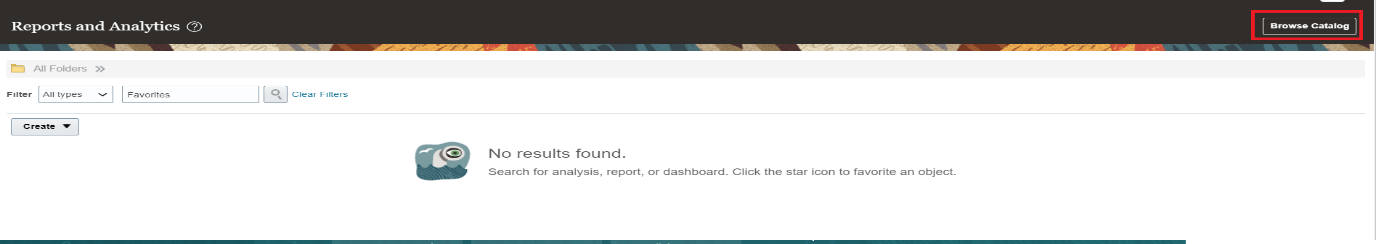

1. Navigate to the Oracle Application Tools Reports and Analytics to Browse catalog

2. Navigate to Reports and Analytics Browse catalog

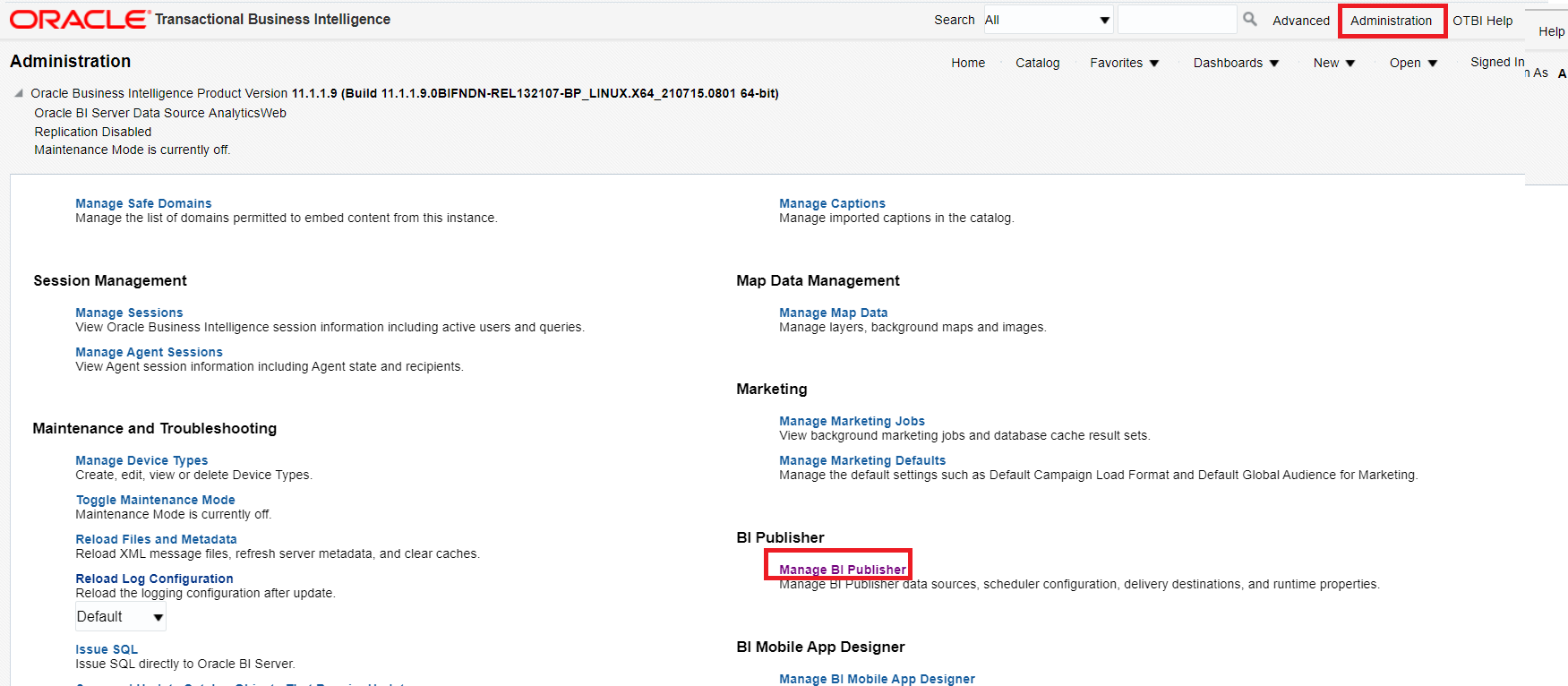

3. Navigate to Administration Manage BI Publisher

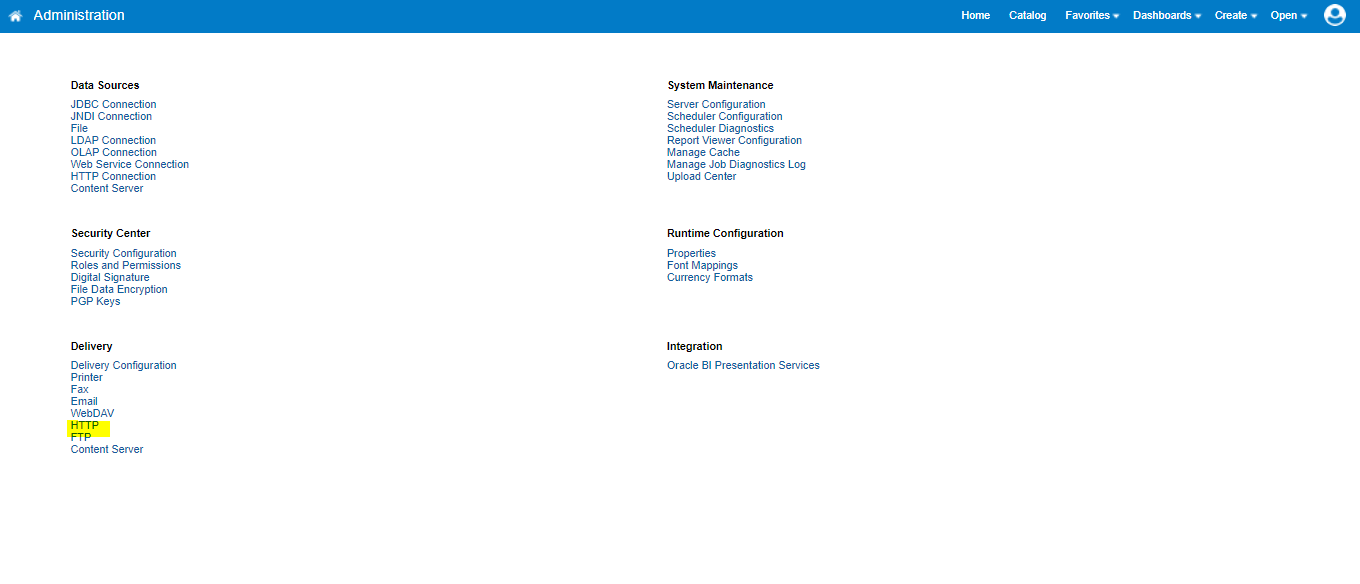

4. Configure the FTP

5. Fill-in the details and click on save

Conclusion

Utilizing Oracle Fusion Application for Banking can change the way banking management is carried out. It can help leverage the overall functionality to the benefit of bank and help in saving costs, while maintaining efficiency.

About Jade as a trusted Oracle Partner

Jade Global is a Cloud-focused implementation, integration, consulting & IT outsourcing Oracle MOPN Partner and we are a member of the Oracle Cloud Excellence Implementor (CEI) Program. Our Services include Consulting & Advisory, Implementation (ERP, EBS, SCM, Cloud.), Upgrades, Development Services, Oracle IaaS/PaaS, Managed Services, and global rollouts. Jade has expertise and specializations in Cloud Applications SaaS (CX, ERP, HCM, SCM), Cloud Infrastructure (IaaS), PaaS, and OCI Implementations. As a certified Oracle Cloud Implementation Partner, we specialize in accelerated and predictable implementation cycles, fuelling faster and definitive growth trajectories for organizations. Our long-standing alliance with Oracle encompasses joint industry solutions and product development. Our clients span multiple industries, including Hitech, Software Services, Retail/CPG, Life Sciences & Healthcare, Manufacturing, Media & Telecom, and Financial Services.