Most Organizations allocate budgets to their departments or divisions at the start of every fiscal year which is then used by individual departments to perform their operational activities. It becomes very important for the organizations to have robust budgetary control in Oracle Fusion in place to keep track and control the expenses.

Budgetary control in Oracle Fusion ensure that unnecessary and unwanted spending can be minimized by implementing proper approvals for genuine expenses so that departments do not overrun their budgets allocated for intended activities.

Oracle provides budgetary control in Oracle Fusion features in the form of Encumbrance Accounting and this blog post will throw light on the key concepts on Encumbrance accounting journal entries along with an example business flow of encumbrance accounting in Procure to Pay cycle.

What is Encumbrance Funds? and where is it used?

Pre encumbrance is a commitment to pay in the future for the goods or services that are ordered but not yet received. It reserves the money for your future payments so the money cannot be used for any other activities than what it is intended for. The amount of money reserved is called Encumbrance. This encumbrance is later converted to expenditures when goods or services are subsequently procured.

What is Encumbrance Accounting?

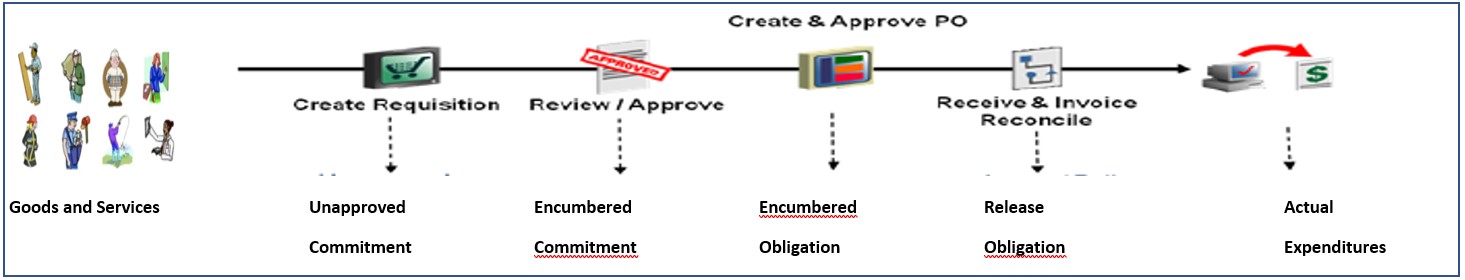

Encumbrance accounting is the accounting of expenses from the time when it is intended to incur till it becomes actual expenditures. Most of the spending happens in any organization during the procure-to-pay process. There are multiple instances on the procure-to-pay process that uses Encumbrance Accounting: creating and approving a requisition, creating and approving a purchase order from the requisition, creating and approving invoice matched to the purchase order, etc.

Terminologies used in Encumbrance Accounting

oracle cloud expenses implementation guide:

The following terms are primarily and widely used in this accounting – Commitment – Money that is committed to spending in the future is called commitment. In Oracle, it is the money committed to being spent on a purchase requisition document. When the requisition document is approved, commitment happens.

- Obligation – When a requisition is converted to a purchase order and the order is approved then commitment is replaced by an obligation. It is an obligation to pay the amount to the vendor against the goods and services ordered as per the purchase order terms and conditions.

- Encumbrance Entry – Journal entry is created when a reservation is placed on a requisition or PO. The type of encumbrance which is created is either commitment or obligation.

- Budget – These are the amounts that are allocated to a particular account or project to spend on planned activities.

- Actual – The actual expenditures that are incurred which offset the commitment or obligation i.e., encumbered amounts. In Oracle, actuals are booked when invoices are received from vendors for the goods and services procured and matched to PO.

- Funds Available – The amount which is not reserved for any purpose and available to be encumbered is called available funds. The formula is:

Funds Available = Budget – (Actual Expenses + Encumbrances)

Encumbrance Accounting in Procure to Pay Process Flow

Encumbrance accounting is primarily used in the Procure to Pay process in Oracle. It starts with Purchase Requisitions and ends when actual expenditures are booked in the form of an Invoice. The diagram below shows Encumbrance Accounting in Procure to Pay flow –

Given below is an example of the business flow –

| Business Transaction | Budget Remaining | Commitment | Obligation | Actual |

|---|---|---|---|---|

| Budget Allotted for Expenditure - $1000 | 1000 | |||

| PR Created for $400 | 1000 | |||

| PR approved for $400 | 600 | 400 | ||

| PO auto-created from PO for $400 | 600 | 400 | ||

| PO approved for $ 400 | 600 | 0 | 400 | |

| Invoice Received and matched to PO for $300 | 600 | 0 | 100 | 300 |

As you can see from the above table, there is no commitment booked when the PR is created. The commitment is booked only when the PR is approved. The same is the case with PO. The commitment is transferred to Obligation when PO is approved. Similarly, the PO obligation is released only when the Invoice is validated and approved.

Here is a high-level Encumbrance Journal Entries in the Procure to Pay cycle

| Activity | Event Type | Encumbrance Type | Debit | Credit |

|---|---|---|---|---|

| Purchase Requisition Approved | Requisition Reserve | Commitment | Budget Account from PR Distribution | Reserve for Encumbrance (Commitment) |

| Purchase Order Approved | Requisition Un-Reserve | Commitment | Reserve for Encumbrance (Commitment) | Budget Account from PR Distribution |

| Purchase Order Approved | Purchase Order Reserve | Obligation | Budget Account from PO Distribution | Reserve for Encumbrance (Obligation) |

| Purchase Order Receipt (When Accrue on Receipt Flag = Yes) | Delivery to Expense Location | Obligation Reversal | Reserve for Encumbrance (Obligation) | Budget Account from PO Distribution |

| Invoice Matched to PO (When Accrue on Receipt Flag = No for Expense Items) | Invoice Match to PO | Obligation Reversal | Reserve for Encumbrance (Obligation) | Budget Account from PO Distribution |

Benefits of using Encumbrance Accounting

Encumbrance Accounting has many benefits for any organization. Some of the key benefits are summarized here -

- Enforces Control: Encumbrance Accounting puts control over expenditures against the allocated budgets. It works together with budgetary control in Oracle Fusion, monitors spending by departments, and avoids overspending.

- Increases Visibility: Encumbrance Accounting increases visibility and transparency in spending by allowing business users to allocate the budget amount in advance for future expenses.

- Accelerates Planning Process: Encumbrance Accounting is used as a planning tool to accelerate the planning process. It is also useful to predict cash outflow.

Conclusion

If your organization is seriously planning to implement budgetary control in Oracle Fusion to keep an eye on expenses, then reach out to us and talk to our experts who have hands-on experience in implementing budgetary control in Oracle Fusion and encumbrance accounting in Oracle with various customers running on different flavors of business processes. Budgetary control in Oracle Fusion and Encumbrance accounting provide a complete solution to proactively control the spending in the entire procure to pay cycle. It also streamlines the financial close process with encumbrance carry forward. With robust reporting and analysis, it allows organizations to improve insights and make better decisions.