Today, every product or service we use is touched by technology or uses technology. The Internet of Things (IoT), NFC, and Bluetooth have invaded a toaster, electric cars, and our homes. Future insurance companies must adapt to these changing landscapes so that in the next decade, a fully tech-enabled insurer will not resemble their present state.

A handful of accelerating Insurance technology trends will transform the very nature of insurance. In auto insurance, risk will shift from drivers to self-driving cars, artificial intelligence (AI), and software. Home sensors will give real-time datasets to insurers with unprecedented visibility into the risk around facilities, leading to greater accuracy.

Ability to use weather data and evaluate satellite photographs after a natural catastrophe for claim processing gives an edge to tech-enabled insurers. To survive, incumbents must adapt their operating models, products, and core processes to a new reality.

“Jade is working to build next-gen insurance industry services and enterprise solutions for these new opportunities to transit insurers to the next level. This is enabled by our investment in IP (Kanverse.ai), in-house product engineering, and product partnerships.”

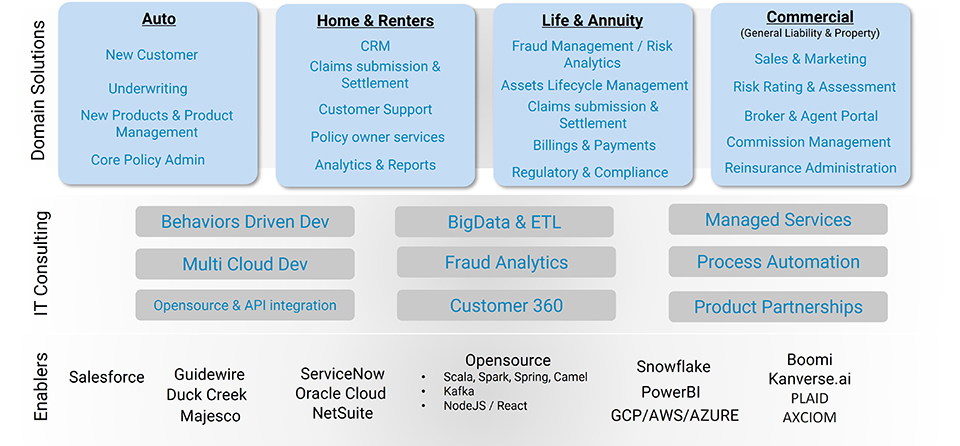

Service Offerings

Critical Trends in the Next Five Years

Jade understands and appreciates these upcoming technical challenges, and we foresee that the following technology trends will shape the Insurance Industry.

Edge Computing and Decision AI

Edge computing will reduce central processing and faster decision-making. These devices help detect risk and trigger alerts in time, thus impacting underlying underwriting. These tiny devices can see machine telemetry, fire alarms, carbon monoxide level, washing machine, and to an extent, air filters.

Edge computing will reduce central processing and faster decision-making. These devices help detect risk and trigger alerts in time, thus, impacting underlying underwriting models. AI is no longer a novelty but a trustable AI model. These models will evolve to correct human bias and service society by large with more humane hands.

Vehicle-to-Vehicle (V2V) Communication

V2V communication’s ability to wirelessly exchange information about the speed and position of surrounding vehicles shows great promise in helping to avoid crashes, ease traffic congestion, and improve the environment. This will be a big boon for self-driving cars, trucks, and even a 16-wheeler.

Go Digital - Mach-1: Blockchain, Digital ID, and Digital Dollar

Today there is a significant emphasis on process automation as there are many unconnected systems, operations, and a backlog of legacy systems. Future systems will build business capabilities, interoperable APIs, and customer experience relying on mobile first.

This digital revolution will reach Mach-1 speed as digital identities like biometric passports, digitized DMV licenses, and possibly a Fed-issued digital dollar will eliminate any human intervention to verify IDs.

Blockchain will ensure the authenticity of issued documents, property registration, and other types of ownership certificates.

5G and Internet in Remote Areas

The Digital revolution will fail to spark without connectivity or low bandwidth. 5G connections will resolve this, and cheap satellites enable wi-fi offered by Starlink, AWS, and others.

This connectivity will connect even the most remote area to the main communication, thus, sending an uninterrupted stream of digitized information. This will open new avenues for Insurers and deepen their footprints.

Insurance Services Value Chain & Jade’s Offerings

Jade understands the insurance business' digital landscape and the end customers' value chain. We offer services to help your business deliver these business services.

Below is a quick snapshot of our domain offerings enabled by our Insurance IT services and product partnerships.

Critical Industry Use Cases Serviced by Jade

Intelligent Document Processing

AI-powered automation has gained immense visibility across the insurance sector.

Identify and automate manual insurance forms processing workflows to reduce operational costs, gain a competitive advantage, and deliver a compelling customer experience.

Jade’s IP Kanverse IDP solution for insurance digitizes forms submission and processing for insurance companies. It intelligently classifies, captures, and extracts all data from forms entering the workflow.

Business Benefits

- Building effective zero-touch ACORD and supplemental forms, processing workflows across business processes.

- Reduced operational costs by optimizing business processes and workflows with intelligent automation.

- Reduced document processing cycle time across business processes.

- Increased productivity and efficiency.

Improve First Pass Resolution Rate (FPRR)

Predictive analytics has opened a world of possibilities in how marketing, underwriting, and claims management are executed and managed today.

Jade’s accelerators and IP help build a digital framework to process claims and achieve a higher pass rate.

- Intelligent triage of claims and optimized manual

- intervention

- Enrich claims data from Customer C360

- Analyze the history and identify fraudulent intent

- Recommend a premium refresh

- Pattern matching with similar cases in a zip code

- Image processing for damage analysis

IoT enabled NOC and Risk Modeling

The IoT has arrived and is rapidly becoming entrenched in the activities we all do every day.

Last year, there were 30 billion connected devices worldwide; that number is expected to jump by a third to 41 billion connected devices.

Jade has enabled Network Operations Center (NOC) rooms to monitor these IoT devices and pick up the signal from the noise.

These IoT-powered NOC rooms can watch a large factory for fire, electrical surge, noise, power consumption, trespassing, and more.

- Useful for large commercial factories or buildings

- Monitoring neighborhoods

- Minimal eyes on the glass; receive classified alerts for action

- Build historical datasets for modeling

- Competitive premium pricing for commercial and custom insurance

Request for services

Find out more about how we can help your organization navigate its next. Let us know your areas of interest so that we can serve you better.