The speed of modernization of the banking system is held back due to aging and complex legacy systems laced with the complex codebase and no documentation.

U.S banks have also adopted digital banking at a galloping rate. According to S&P Global Market Intelligence data, last year U.S. banks shuttered 2,927 branches.

While the Fintech ecosystem is starting new from the public cloud as their first choice, traditional banks are at risk of taking critical systems to the public cloud.

“Jade is focused on these tectonic changes in the Digital economy. Our services support our customers to embrace “Open Banking” API development, integrate multiple payment gateways, and update credit risk models for larger and wider segments.”

Service Offerings

Key Trends in the Next Five Years

Companies in the financial services sector embrace technology at a rapid pace and so are the technology companies that are offering financial services. Big Tech companies lead from the front to adopt financial technology and many innovative players.

The following key trends in the next five years will shift the market and challenge even the most technologically advanced banks.

Digital Dollar – Fed-issued stable fiat currency

With a proven backbone of Blockchain, Fed-issued digital dollars are not too far away. This will significantly impact most of the IT system rewrites.

The introduction of a tokenized digital dollar would be a driver of innovation for the broader financial system in a fundamental way. A tokenized digital dollar as a new financial medium, combined with new transactional infrastructure such as distributed ledger technology, would provide a new payment rail, upon which, central bank money can be sent and received.

Metaverse economy

Pioneered by Meta, the metaverse economy will grow from its current size of $60B to $1.6T by 2030. Fintech innovates faster than traditional banks to build payment gateways, stores, retail stores, and a vast marketplace.

For this, banks must adopt blockchain at a faster rate. The cybersecurity approach and fraud detection methodology, too, will need a whole relook.

Public Cloud powered FinTech’s

Fintech does not have the burden of legacy code and they start from the public cloud. They rapidly integrate with other cloud-based solutions and services, giving them an edge over financial services companies with a rigid IT approach.

Companies can divert funds to new product development and core business needs by avoiding heavy capital expenditure in data centers.

Regulatory Technologies (RegTech): Stricter Legal and Compliance

Since the financial crash in 2007, an estimated $52 billion in enforcement actions has been levied on financial institutions and individuals for non-compliance with Anit-Money Laundering (AML), data privacy, and Markets in Financial Instruments Directive (MiFID) compliance violations. This is a mere drop in the ocean compared to the estimated $2.4 trillion in illicit cash that flows through the financial system each year.

Every year, across the globe, governments build stricter AML laws. But financial crimes are a step ahead by finding newer means to launder money. RegTech is an emerging field focused on detecting layered transactions, continuous KYC/KYB refresh, and being able to connect two unrelated transactions.

Open Banking API and Data Fabric

Open Banking API integration provides flexibility to customers and creates a level of competition for new entrants.

The ecosystem of sharing banking “systems and data” with trusted partners will help expand the market size, build trust between partners, and possibly reduce third-party fraud preemptively.

If available finance continues to accelerate, it could reshape the global financial services ecosystem, change the very idea of banking, and increase pressure on incumbents

Financial Services Value Chain & Jade’s Offerings

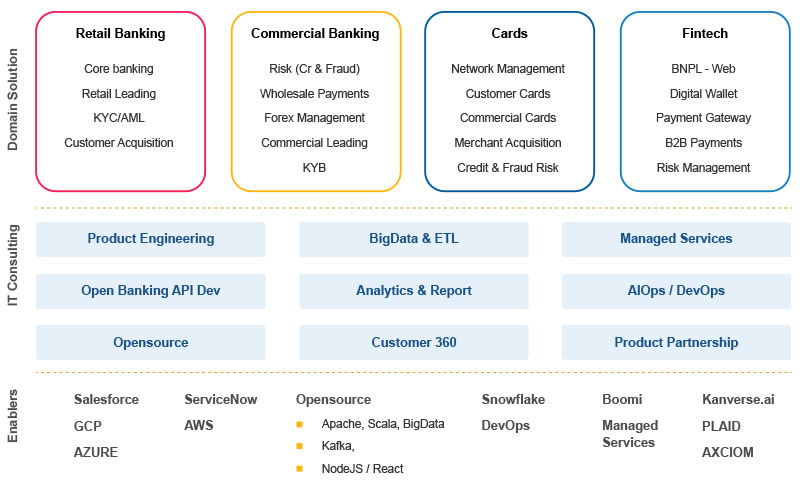

Jade understands the banking business' digital landscape and the end customers' value chain and we offer services to help your business deliver these business services.

The following is a quick snapshot of our domain offerings enabled by our IT support services for the financial services industry and product partnerships.

Key Industry Use cases serviced

Digitized KYC/KYB refresh

Since 2007, an estimated $52 billion in enforcement actions has been levied to financial institutions and individuals for non-compliance with AML, data privacy and MiFID* compliance violations.

- We address this challenge by building end-to-end digitization of KYC/KYB process.

- Go digital through API integration and Workflow-Integration that binds IT and operations

- Build solid customer 360-degree view by harnessing Big Data

- Leverage AI/ML and Robotic Process Automation for efficiency and accuracy

- Program Visibility – Transparency enabled by a Live Dashboard

Open Banking Integration

The rise of APIs in banking and Open Banking models have led to a major new disruption, that of BaaS (Banking-as-a-Service). It’s an opportunity for a platform provider to offer white-labelled bank account solutions to third parties.

Jade recognizes this as a big opportunity and offers Open Banking services such as:

- Insight to transaction and balance inquiry

- Integrated view of multiple banks, cards, and mortgage accounts

- Control or auto enable lending limits of SME Customers

- Mitigate risk of integration with third parties

B2B Payments

Global market size for B2B Payments in $120 Tr and US share is $ 25 Tr.

High processing cost, fraud risk, payment delays, and manual AP processing are key challenges

- Jade offers digitization and automation of treasury functions

- Define AP Automation Strategy by market and buyer size

- Advisory on B2B Payment Partner selection and Partner integration strategy

- Custom AP Automation rollout for large market

- Pricing Model and Discount structure by Partner, Supplier, and Market

- Risk Modeling for Cross Border Payments/FX pricing/AML

Request for services

Find out more about how we can help your organization navigate its next. Let us know your areas of interest so that we can serve you better.