| Today’s CFO has moved from 'Finance and Accounting Owner' to a 'Partner to the CEO.' Moving the finance function from an audit/compliance position to a directional business role. With the change in roles and responsibilities, associated tasks, too, have to change. Technology is a great enabler for this transition. Robotic process automation in financial services has a pivotal role in automating routine, mundane necessary tasks to free up capacity in the CFO organization. |

RPA, coupled with AI and ML, helps build, deploy, and manage BOTs capable of imitating human actions while interacting with enterprise systems and unstructured data such as emails, PDF documents, images, etc.

Sophisticated RPA technologies like UiPath, Automation Anywhere, Power Automate, etc., automate highly repeatable back-office mundane tasks across industries, delivering more efficiency, speed, and accuracy.

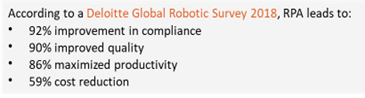

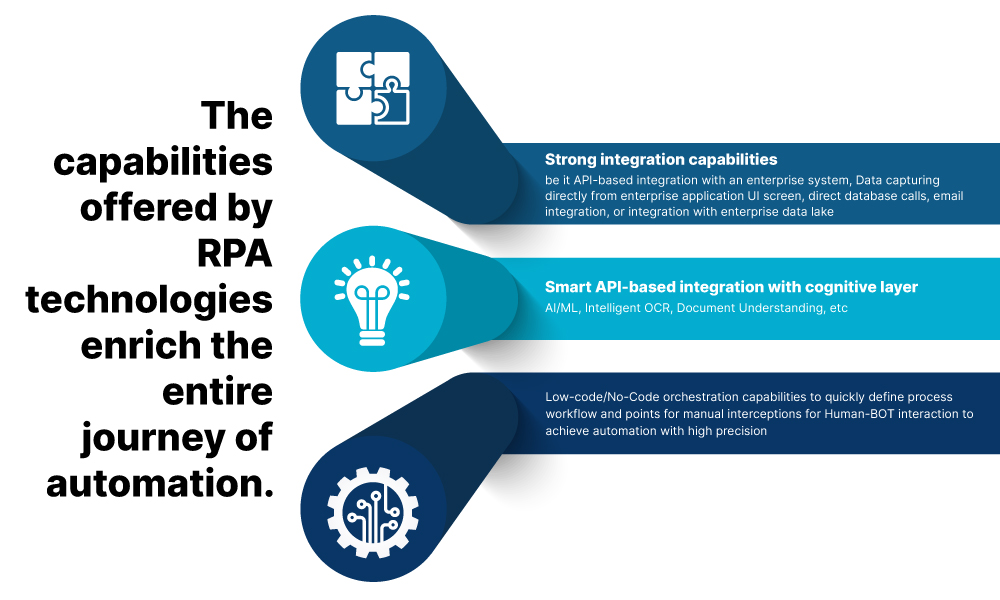

Benefits of RPA technologies

- Out-of-the-box integration capabilities with enterprise systems.

- Captures data directly from the screen of systems

- Facilitates quicker development of automation processes through low/no code capabilities

The way forward for CFOs to overcome these challenges is to adopt digital transformation to the 'Last Mile.'

McKinsey Global Survey, April 2018, suggests that you need not look any further than the CFO role. In the two years since our previous survey on the topic, CFOs say the number of functions reporting to them has risen from about four to more than six. What’s more, the share of CFOs saying they oversee their companies’ digital activities has doubled during that time. And many finance leaders say they are being asked to resolve issues in relatively new areas while continuing to mind traditional responsibilities, such as risk management, that remain business priorities.

'Last Mile' digitization is a movement from manual to tactical and from tactical to strategic by automating manual tasks using technologies like Robotic Process Automation (RPA), Artificial Intelligence (AI), Machine Learning (ML), Intelligent OCR, etc.

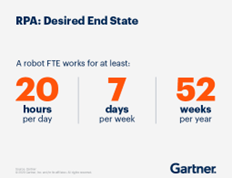

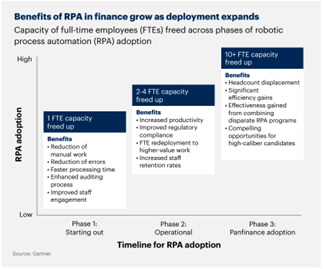

Using finance robotic process automation, CFOs can achieve 'Task Automation' by getting highly repeatable manual tasks, like data entry, automated up to 80%+, thus freeing up precious human capital capacity available for high-end tasks, saving back-office operation cost and filling gaps due to shortage of skilled human resources.

One suggested prerequisite to automation is a review of existing business processes and streamlining them before automation.

Despite the automation of repeatable manual tasks, most CFO organizations’ human workforce must deal with a large amount of semi-structured unstructured data. Such data might be in paper documents, PDFs, Images, eMails, etc.

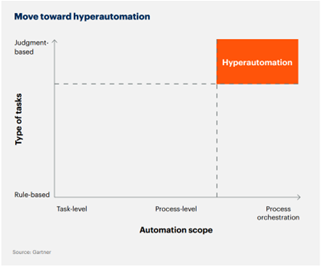

Dealing with a massive amount of data requires human intelligence and effort. CFOs can leverage AI/ML and Intelligent OCR/Document understanding to read data from sources of unstructured data sources. These technologies sit on top of RPA and thus bring cognitive capabilities to task automation to achieve complex financial process automation.

A combination of finance robotic process automation and Cognitive technologies can further be expanded for high-value financial process automation like projections/forecasting, price prediction, credit risk detection, customer churn prediction, etc. In this state of hyper-automation, CFOs can divert their workforce to analyze the outcome of such automation instead of focusing on data cleansing, normalization, creating projections, etc.

Gartner depicts a CFO’s automation journey in its report 'The Digital Future of Finance 2021.'

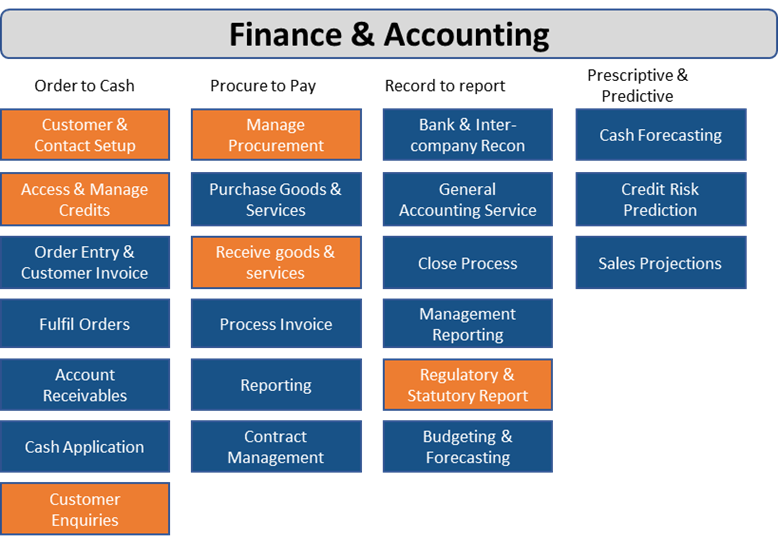

The automation process map below depicts a quick reference for CFOs on automation opportunities in finance & accounting functions. Blue boxes refer to process areas that can be fully automated, while orange are those process areas that can be partially automated using RPA and hyper-automation

Source:

The CFO’s role: Prioritize, transform, repeat | McKinseyRobotic Process Automation (RPA) Role in Finance Automation | Gartner

Global RPA Survey 2018 | Deloitte

10 CFO Strategies to Drive Digital Finance Transformation | Gartner